Small Business Funding Explained: How To Secure Loans, Grants, Crowdfunding, And Venture-Backed Capital

You’ve got a business idea for a store or service that you’re sure everyone will want. How do you make your entrepreneurial dream a reality? Securing funding is your biggest task as a founder, and the good news is you have tons of options. Read ahead for a comprehensive guide on the most popular funding options for small businesses and how to know what you qualify for.

What You'll Learn In This Blog

- The reasons funders award capital

- Understanding the nuances of your funding needs

- Small business funding guide chart

- Business loans: Traditional funding for new businesses

- Grants: Free money with strict criteria

- Venture-backed funding

- Crowdfunding: raising funds from your community

- Can you use more than one small business funding source?

- The keys to business funding success: two real-life examples

The Reasons Funders Award Capital

Needless to say, starting a business without an idea or plan is a hard sell to lenders. Funders want to see precisely how you plan to spend their investment. That plan influences the options available to you.

Three major reasons new businesses seek funding are:

- Operational costs: If you need assistance covering day-to-day operations, working capital loans cover payroll, utility bills, and other everyday expenses.

- Inventory expenses: When your wholesale business needs to stock up on supplies before operations begin, inventory financing supports bulk purchasing.

- Equipment financing: Machinery is expensive. Equipment loans help get eligible businesses up and running.

When it’s time to take it to the next level, there’s funding available for that, too. Expansion loans are designed to drive growth.

Power Up

Understand what it takes to bring in your first order of inventory and how to build a system that optimizes your stock and increases profitability.

Understanding The Nuances Of Your Funding Needs

Identify why you need funding

Knowing what your new business needs to get off the ground is essential to a successful application.

Let’s say you’re getting ready to open a clothing boutique and need support to advertise your grand opening. Small business loans meant for marketing projects are likely your best option. Or perhaps you’re starting your entrepreneurial journey by acquiring ownership of an existing retail store. Business acquisition loans will finance your purchase.

Set realistic funding goals

The average small business loan is just under $440,000, but funding amounts range anywhere from under $10,000 to over $1 million, depending on your funding intentions. Working capital loans, for instance, are typically smaller than loans to open a second location. The funder ultimately decides how much your business gets. But putting a minimum price tag on your needs gives you a better idea of which sources are worth pursuing in the first place.

Power Up

If you’re thinking about expanding to a new location, here are five questions to ask yourself first.

Assess your risk tolerance

Take repayment into account. How much debt can your business take on? Loans with high interest rates or short repayment terms aren’t always a good fit for a growing business that’s still working to boost profitability.

Additionally, are you giving up partial ownership in exchange for capital? If your funder requires equity in your new company, you have to decide how much control you’re comfortable relinquishing.

Small Business Funding Guide Chart

Which funding source is the best choice for your unique business needs? This overview of what each type has to offer will help you know where to start:

Funding Type | Main Funding Source Benefit | Biggest disadvantage | Best Option For Businesses That: | Loans | Access to large amounts of capital | Repayment required, Funding acquires interest | Need substantial funding quickly |

|---|---|---|---|

Grants | Funds that don’t require repayment | Extensive applications, Highly competitive | Have a specific project or mission |

Venture Capital | Businesses that don’t meet traditional resource qualifications get funding opportunities | Giving up future profits, ownership, or say in major decisions | Startups and innovative entrepreneurs |

Crowdfunding | Gain funding from multiple sources while growing your audience | Fee-based platforms, Reaching your fundraising goal isn’t guaranteed | Business owners with an existing network or a mission that resonates with the community |

Business Loans: Traditional Funding For New Businesses

Small business loans explained

Small business loans are one of the most common ways to gain quick access to capital. You’ll borrow a set amount and repay it within a specific timeframe, along with any interest and fees agreed to in the loan terms.

Secured loans require collateral, such as business or personal real estate assets, in case of failure to repay, while unsecured loans do not require collateral. Secured loans typically have lower interest rates than unsecured loans.

Banks and credit unions are the most prevalent lenders, although alternative funders are an option as well. Alternative lending sources that you already have an established relationship with, such as Square Loans or Shopify Capital, potentially offer even faster approval with fewer requirements for applying.

Common business loan types

- Personal loans for business purposes. Rising entrepreneurs who do not have lender relationships yet are a good fit for this loan type, especially if they have a good personal credit history.

- Line of credit. The lender extends a certain amount of money, and borrowers can withdraw from that amount as needed while only repaying the amount they took out. Organizations that need the greatest flexibility often apply for a business line of credit.

- Business term loans. This type of fixed, lump-sum loan is ideal for established businesses looking to expand or cover seasonal gaps in cash flow. Qualifications are usually strict and often limited to businesses that have been operational for at least six months.

- Microloans. For those that only need a small amount of capital, microloans for small businesses help with short-term expenses, such as inventory purchasing or equipment repair.

Small Business Administration (SBA) loans

If you’re starting your own business, Small Business Administration loans are a valuable financial resource. Government-funded lending for small businesses is competitive and involves a lengthy application, but you get more affordable terms in exchange. For example, SBA 7(a) loans offer up to $5 million for new and expanding businesses, with no repayment penalty for as long as 15 years.

Since the SBA exists to promote a prosperous small business community, underserved populations are often given priority. For instance, SBA loans are a great option for owners within a specific demographic or geographic area, such as women-owned, veteran-owned, and rural businesses. The SBA also offers local support, such as expert training and networking, for businesses just getting off the ground.

Pros and cons of small business loans

Fast access to large amounts of capital is the greatest advantage of financing through loans. You won’t have to give up any equity either, allowing you to retain total ownership once your company becomes profitable. When you make payments on time, you’ll steadily increase your business credit score, a crucial component to getting funding in the future when you’re ready to expand.

Unfortunately, though, many loan requirements exclude startups and new businesses. Some applications may require extensive documentation. You’ll also likely have to pitch to multiple funders before you finally get the greenlight on a loan. And most importantly, loans are expensive in the long run if the interest rate is high.

Small business loan application checklist

Once you’ve found a loan that suits your needs and you’re ready to apply, gather all of the required documentation. You’ll want to confirm exactly what your specific funder needs from you, but you’ll generally need to submit:

- Business plan. Include a detailed strategy for your new company with projected financials, a plan for marketing and sales, and a current market analysis.

- Financial plan. Provide a breakdown of operational and production costs, along with a market analysis of current trends in your industry.

- Financial statements. Typically, lenders will ask for a balance sheet, personal tax returns, and bank statements.

Additionally, lenders will run a credit report.

How to increase your chances of approval

If you want the lending odds to be in your favor, you’ll need to show proof of financial responsibility. A high credit score and low debt-to-credit ratio are the first signals that you’ll make your payments on time. Review your credit report before applying to ensure all the information is accurate.

Finding the right funder, with loans designed to meet your unique needs as a new entrepreneur, is also key to approval. In some cases, it may help to apply for a loan with your existing personal bank where you’ve already got a strong track record. You should still conduct thorough research, though, to see what other options exist.

Grants: Free Money With Strict Criteria

Business grants: A high-level overview

If the thought of adding loan repayments to your monthly expenses sounds less than ideal, grants provide funding that you never have to pay back. While business grants are essentially free money, the application process is heavily detailed and highly competitive. To that end, finding a funder that fits your business niche is most important.

Resources for your grant needs

Grants are offered by a range of funder types, including corporations, non-profits, and government grants. Platforms such as grantwatch.com aggregate open grants from a variety of sources. For those seeking business expansion funding, Grants.gov offers many opportunities.

Since grant funders are often looking to fulfill a very specific mission need, business owners with a particular project in mind are ideal candidates. For instance, the National Association for the Self Employed (NASE) Growth Grants Program provides microloans to help with expenses like equipment costs, marketing materials, and seasonal hiring.

Businesses that promote sustainable practices are also a great example. If you’ve got plans for an innovative, environmentally friendly product, a Small Business Innovation Research grant opens the door to making it happen.

Pros and cons of grants

Grant funding allows you to start a business without adding to your financial burden. When you don’t have to worry about repayments, you’re free to spend that money on growing your business.

Grant awards also impact your financial viability long into the future. Winning a prestigious grant before you’ve even started your business shows other funders that you’re a worthwhile investment. Plus, it gives you a competitive edge over other small businesses in your field, giving you additional potential to attract new customers. Some grants also offer opportunities for business development and other resources to ensure your success.

The price for all of this, though, is finding a way to stand out among the competition. Grant funders are extremely particular in their selection, so it’s not enough to meet all of the application requirements. In addition to providing all required documentation, you’ll need a strong proposal that demonstrates your business closely aligns with the funder’s mission.

Grant writing is a skilled art, so familiarizing yourself with grant application best practices is vital. The work isn’t over after you win a grant, either. Your funder will expect regularly scheduled progress reports to ensure you’re using the funds as originally awarded.

What you’ll need for your business grant application

Similar to business loan applications, grant funders will ask for detailed financial documentation, such as a budget and tax records. On top of the required supporting documents, you’ll draft a thoroughly targeted proposal that proves your business idea will serve the funder’s mission.

Your application will likely require a:

- Cover letter: You’ll write your elevator pitch.

- Executive summary: Outline project goals.

- Needs assessment: Make your case for funding.

- Project description: Break down precisely how you plan to use the money.

Advice for business grant success

Grants for small businesses are challenging to win, but with the right approach, it’s completely possible, and worth the effort. Here’s what to prioritize when applying:

- Research the right funders: A targeted approach is key. It’s not a wise investment of your time to apply when you don’t meet all of the criteria.

- Speak to your audience: Your grant application needs to clearly outline how your new business connects to your funder’s mission. Tailor your proposal as specifically as possible.

- Build a relationship: If you’re unsure how to craft your proposal, go directly to the source. It’s OK to ask for advice on what the grant funder’s organization wants to see from grantees.

- Don’t give up: An initial rejection doesn’t mean this isn’t the right path for your business. Every grant application provides a learning opportunity. Don’t be afraid to reach out to the funder and ask for feedback.

Venture-Backed Funding

Venture Capital 101

Common in startup funding, venture capital (VC) is granted by an investor in exchange for partial ownership of your business. It’s in the same vein as angel investors, except that venture capitalists are backed by risk capital organizations, whereas angel investors are spending their own personal funds.

VCs often open doors for business owners who don’t qualify for other sources of funding. Venture capitalists are willing to bet on higher risk, and new businesses are often seen as risky by lenders, for a return on their investment. Similar to grants, investors typically support a specific goal, from supporting technological innovation to community enrichment.

When securing venture funding, you’ll go through the following stages:

- Pre-seed stage: VCs often invest a little money in what’s essentially a trial run. It might involve initial product development or market research, but the overall objective is to show that your business is viable.

- Seed stage: The bulk of your funding is awarded in this phase, allowing you to begin full scale operation.

- Late stage: As your business grows, final rounds of funding help you sustain your progress.

Pros and cons of venture capital funding

Partnering with an investor comes with more than financial assistance. They also have a wealth of resources you can’t put a price on. Venture funding means working with a seasoned business expert with the knowledge and connections needed to guide you in areas like technical assistance and fine-tuning financial projections.

But the other side of that is agreeing to give up some control. Pre-seed funders expect about 15 to 30% equity (although the precise percentage varies greatly), and they’ll generally want a say before you move forward with certain business decisions. You have to assess whether a venture funder is truly the right partner for your vision beyond supporting your financial needs.

How to find a VC backer

Online databases such as OpenVC and VisibleConnect let you search through thousands of investors to find the right fit. Networking with other business founders is also useful. In addition to VC connections, you’ll also get the chance to pick the brain of someone who’s been through the process.

When you do find a potential investor, preparation before your pitch is essential. You’ll have to prove that your business offers a strong market opportunity. Be ready for questions that test the expertise of your industry. Having an idea of what venture capitalists will ask ahead of time helps you craft fundworthy answers.

Remember, if a VC backer isn’t ready to fund your business, meeting with one is still an important relationship-building opportunity. Asking for feedback demonstrates your willingness to adapt. Keeping the line of communication paves the way to funding opportunities in the future when you’re ready to expand.

What to know before approaching a VC backer

Startups in rapidly expanding markets are an attractive bet for VC funders. For example, quick service restaurants (QSR) have blossomed into an over $330 billion industry, making them a tempting investment for VC backers.

Just because your business represents a profitable opportunity doesn’t mean venture capital is the right choice for you, though. Venture funding is a commitment, so prioritize backers that you see yourself working with for the long term. Look for funders with a strong reputation in your industry and a track record of balancing helpful guidance with respect for your business vision.

Crowdfunding: Raising Funds From Your Community

Crowdfunding types

As the name implies, crowdfunding finances your business through multiple small investors. Individuals who believe in your business idea have the chance to donate whatever amount they’re able to afford through a crowdfunding campaign, usually facilitated through a third party platform. There are multiple forms of crowdfunding, including:

- Equity crowdfunding: Backers are awarded a stake of ownership in your business.

- Reward-based crowdfunding: Backers get prizes tied to funding tiers. For instance, funders who give over $1,000 would get an exclusive beauty consultation for supporting your new cosmetic line.

- Donation-based crowdfunding: Funders simply donate to support your idea, with no expectation of a reward.

Pros and cons of crowdfunding

Crowdfunding is another viable alternative for small businesses that don’t meet the criteria for traditional loans or grants. It’s also an opportunity to build loyalty and attract customers while you earn the money your business needs. With the exception of equity-based crowdfunding, you’ll be able to raise funds without giving up control, giving you more freedom to operate on your terms.

There are drawbacks to pursuing crowdfunding, though. Unless you’ve already got a large community behind you, marketing your crowdfunding campaign takes a lot of time and resources. There’s also no guarantee you’ll meet your financial goals.

Preparing to launch a crowdfunding campaign

When it’s time to craft your crowdfunding plan, you’ll begin with the type of campaign you want, along with a reward structure if appropriate. Remember: you’ll have to craft a story that inspires everyday people to give their hard-earned money, which is a very different skill than pitching an investor.

Your strategy should also include a realistic timeline of funding phases. Think about:

- How long do you need to create buzz around your campaign before launching?

- Once funds are raised, how and when do you plan to distribute rewards?

- What’s your communication timeline for keeping backers in the loop?

Selecting the right crowdfunding platform is also key. Popular platforms such as Kickstarter and Indiegogo have a long history of hosting creative campaigns. GoFundMe and Chuffed are ideal for mission-driven fundraising, while Crowd Supply is tailored for product development.

Tips for crowdfunding success

If you want to cast a wide net with your crowdfunding campaign, a compelling narrative is critical. Tap into the power of video, and what will essentially be your business’s first ad, to spread the word.

Crowdfunding campaigns give you a unique opportunity to connect with your audience beyond your content, though. Communicate regularly with your backers and establish clear expectations from the start. Supporters should know when to expect updates on your project, and most importantly, when they’ll receive any promised rewards.

On that note, your rewards should offer real value to your audience. They don’t have to be high effort offerings, but they should be meaningful. Something as low-lift as name recognition or as resource-intensive as exclusive experiences are on the table here. Getting ready to start a liquor business? Promise to name your finest whiskey after the backer who gives the most, and watch donations start to pour in.

Can You Use More Than One Small Business Funding Source?

Yes! Small business financing is not all or nothing. Blending funding sources is a completely legitimate way to reach your business goals, especially since different types of funding are preferable for different stages of your company.

Consider a new home goods store. A microloan makes sense for short-term inventory purchases ahead of holiday sales surges, while crowdfunding is a good route to drum up support for a new line of kitchenware.

Mixing funding sources minimizes your financial risk as well. If your financial roadmap includes more than one route to your goals, that’s additional flexibility that gives you some breathing room.

The Keys To Business Funding Success: Two Real-Life Examples

Cruisin Kids wins with data

Hard data is a crucial part of a successful financial pitch, and Cruisin Kids knew exactly how to incorporate it in their funding narrative. In 2021, the children’s apparel store sought to acquire a second location when another local retail store was set to close its doors. To make that happen, owner Karri Schauff needed a bank loan.

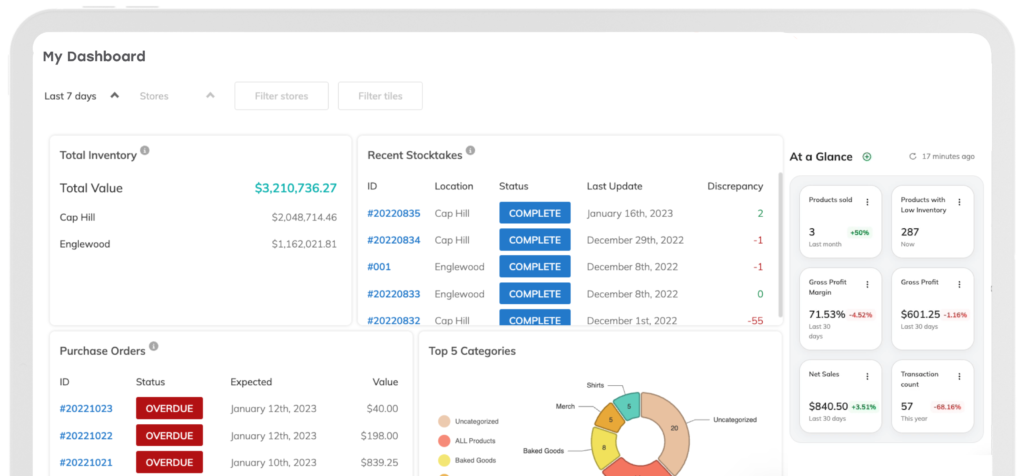

Making her case was easy with the data from Thrive Inventory’s financial reporting. Karri emphasized that having sales and inventory numbers readily available instantly gave Cruisin’ Kids the credibility needed to secure funding.

“Honestly, I think having that on the computer was probably to the bank like, ‘oh yeah, she knows what she’s doing,’” Karri shared. Now in charge of both Cruisin’ Kids and Walker’s Clothing and Shoes, Karri and her team have over 44,000 SKUs between the two stores to serve their growing audience.

Crusin' Kids Success Story

With strong inventory management and payment systems in place, Karri had the confidence to acquire a business over ten times the size of Cruisin’ Kids.

Kushae sells VC backers on their product story

When women’s health business Kushae was ready to get off the ground, convincing venture backers to invest wasn’t easy. In a world where tech ventures often get first priority, convincing funders to get behind a consumer product was no simple feat. But co-founder Kimba Williams knew Kushae had a compelling story, and she wasn’t afraid to remind potential investors that products hold tremendous economic power.

“Everybody’s into tech, it’s so sexy, and I get that,” Kimba explains, “but I always remind people that large global economies like the U.S. survive on their gross domestic product, not the gross domestic tech… at the end of the day, everything that you wear, that you own, is a product. So let’s not forget the power of products.”

Ultimately, Kimba’s efforts garnered more than $2 million in funding from VC backers and angel investors. The narrative she presented got such a positive response that Kushae had to turn interested funders away. Now Kushae has gone from boot-strapped to venture-backed with their products in major stores like Whole Foods and Wegman’s.

The Powerup Podcast: Kushae

Women’s health is a difficult topic to approach, but not for Kushae. Hear how Kimba Williams and Dr. Barb OB/GYN have made it approachable, fun, and even sexy.

Small Business Funding Offers Many Routes To Your Financial Destination

With diligent research, unwavering persistence, and a solid business plan, it’s only a matter of time until you find the funding source or sources that have been waiting to help out a business just like yours. And remember: funding isn’t a one-time act. If you don’t qualify for one opportunity, keep going. The more tools you pack into your financing toolbox, the better equipped you’ll be to grow your business.

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

The Only Inventory System That Actually Helps You Run A Healthy Business

Thousands of customers all over the world use Thrive Inventory to run a healthy business.

Thrive Inventory gives you control over all your inventory, sales channels, and metrics, allowing you to make the right decisions at the right time.

Keep Reading

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

Try Thrive Inventory For Free

Add Thrive Inventory to your business and maximize your potential. With powerful and easy-to-use products,

it’s time to take control of your business and see what you can do with Thrive Inventory.