Small Business Resilience: 10 Strategies During Economic Instability

During times of economic uncertainty, whether globally or locally, small businesses are often the first to feel the impact. How can companies stand strong as the sand shifts beneath them? The answer lies in planning ahead with proven tactics for weathering the storm.

While uncertainty is unavoidable when running a business, it doesn’t mean success isn’t possible. There are proven strategies tailored for small business retailers, especially those that source their inventory from vendors rather than manufacturing in-house. These strategies help retailers remain profitable, retain customers, and maintain a competitive edge even when the economy is unstable. In this guide, we break down actionable, real-world tactics for weathering economic storms.

The Impact Of Economic Uncertainty On Small Businesses

Periods of economic uncertainty are driven by multiple overlapping forces. Inflation, rising interest rates, political instability, disrupted supply chains, and unpredictable tariff policies — all of which have affected retail in the 2010s and the 2020s — have a significant influence.

For small business retailers, the ripple effects of economic disruptions are immediate and often more intense than for major retailers. Here’s how:

- Vendor price hikes strain margins: Rising prices from vendors due to tariffs, global inflation, or shipping delays make it harder to maintain healthy profit margins. Many small businesses operate with limited resources and they cannot easily offset price increases like big box stores.

- Business expenses keep climbing: Increased operational costs, including rent, wages, packaging, and logistics, compound financial pressure. Retailers must find ways to maintain margins without alienating price-sensitive consumers.

- Consumer spending shrinks: Declining foot traffic and online sales result from shrinking consumer spending. Shoppers prioritize essentials and limit discretionary purchases, directly affecting cash flow and inventory turnover for many businesses.

- Cash flow issues begin: Accounts receivable and accounts payable issues become more common as other companies and customers struggle to keep up with the bills. When customers spend less, invoices are paid later, and financial resilience weakens.

- Supply chain disruptions hurt devoted customers: Product delays and stock shortages caused by disruptions in retail supply chains leave shelves empty, frustrating loyal customers. This negatively impacts customer retention and erodes brand loyalty.

How Shifting Consumer Behavior Reflects Economic Changes?

Consumer behavior changes rapidly in an economic downturn. People reassess their spending, delay non-essential purchases, and shift priorities when it comes to buying and saving money. These changes aren’t just surface-level; they are deep shifts in shopping habits, values, and perceptions of what’s worth the money at this moment. Retailers who understand these behavior shifts and adapt quickly will retain customers, while those who ignore them risk losing relevance.

When consumers face higher prices, declining incomes, or job insecurity, they become far more discerning. They seek value, not just in price but in quality and versatility. Retailers must respond with affordable product assortments, clear retail assortment planning, and value-driven product selection that aligns with reduced budgets and elevated expectations.

Key shifts in consumer buying behavior during economic uncertainty include:

Strategies To Help Your Business Prosper In Tough Economic Times

1. Connect with your core customers when the economy wavers

Marketing in downturns requires care. You cannot effectively sell to customers you don’t understand. During times of economic uncertainty, it’s crucial to dig deep into your target audience’s mindset. It doesn’t matter if you believe a product is worth the purchase if customers disagree. Check your communications for messaging that could be perceived as tone-deaf in a difficult economy. Show that you understand what your customers are going through, and focus on products or services that solve their problems.

Instead of cutting down on your market budget, use data to segment by behavior, not just demographics. What are their current pain points? How have their spending patterns changed? Emphasize value, flexibility, and community. Refining your insights into your audience’s preferences, behaviors, and needs influences everything from marketing messages to retail assortment planning and pricing strategies. The more precise your targeting, the better your results in unstable times.

For example, a local fitness apparel retailer noticed its high-end athletic gear was no longer moving. Upon reviewing customer behavior, they realized shoppers shifted to buying functional, multi-use pieces. By adjusting their messaging to highlight durability and value while introducing a few lower-priced essentials, they were able to meet their target audience’s needs, improving customer loyalty and retention.

2. Add value with essential, everyday products

When times are tough, customers zero in on everyday goods. While your business may not typically sell commodities, incorporating a few strategic items attracts new customers who are budget-conscious.

Think beyond your core product line. If you’re a boutique bookstore, consider additions that complement your existing books and journals, like selling pens, snacks, coffee grounds, and local soap. By offering appealing, inexpensive add-ons, you encourage impulse purchases and create the sense of a treasure hunt, which bargain hunters love. This even leads to improved inventory turnover because new items cause consumers to look around your store and pick something they didn’t come in for.

This strategy is particularly helpful when consumer buying behavior shifts toward practicality. Offering inexpensive items builds basket size and creates a sense of value, which is essential when price increases are unavoidable.

3. Streamline your product offerings for efficiency and focus

An overloaded or stale product assortment ties up cash and limits agility. During uncertain economic periods, focus on demand-driven inventory planning. Eliminate or temporarily pause big-ticket items and slow movers that don’t align with current consumer spending habits.

Use analytics to identify what’s underperforming. If a product hasn’t sold in 60 days and takes up valuable shelf space, put it on sale and then replace it with something more aligned with current buying habits. This shift improves cash flow, reduces storage costs, and makes room for items that meet evolving demand.

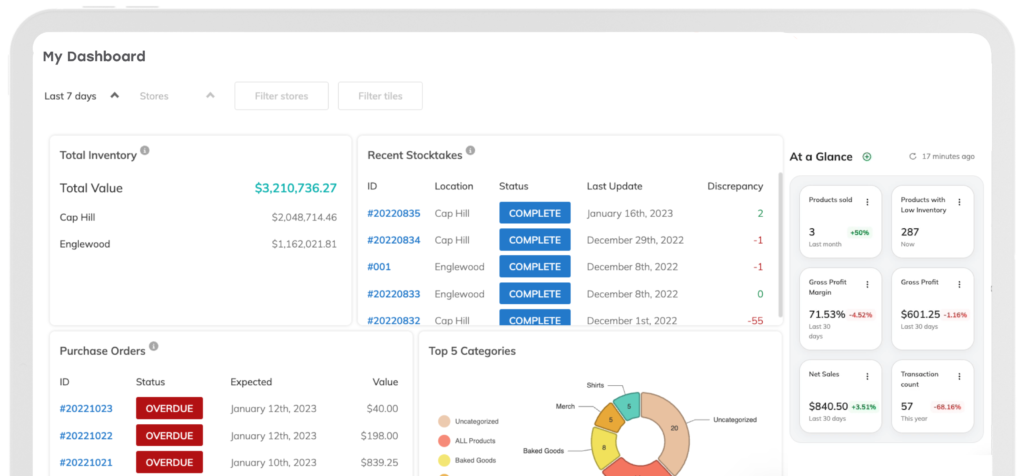

Make Smart Product Decisions With Thrive Inventory

Tap into Thrive Inventory’s reporting to quickly identify products that aren’t top of mind for consumers in an economic downturn and products that are becoming more relevant.

4. Widen your product line to attract broader markets

Strategic product assortment optimization means narrowing your inventory or expanding it smartly. Assortment diversification strategies help stabilize sales during downturns. Having the right variety in-store for consumer preferences is the difference between a sale and a walk-out.

Target new segments without abandoning your core. Live Well Mattress took this approach when the COVID-19 pandemic began and mattress sales came to a screeching halt. The company opened a boutique store within its retail space, offering sleep-related products such as. The decision to change course paid off, helping their business survive that period of economic instability.

Power Up

Learn how Javier, owner of Live Well Mattress, used customer research and trends reporting to expand and optimize his product assortment during the COVID-19 pandemic on The Power Up Podcast.

5. Strengthen customer loyalty through rewards and incentives

Loyal customers are your safety net during turbulent times. A robust rewards program reinforces customer loyalty, encourages return visits, and strengthens customer retention.

Let’s say a gallery notices a drop in attendance. The retail gallery works with its artists to draw in crowds for a meet and greet or Q&A exclusive to gallery members or those who registered for a loyalty program. This creates a unique experience that makes customers feel special, with very little overhead.

6. Create multiple income streams to reduce risk

Having only one source of revenue is risky in any economy. During downturns, consider introducing pricing tiers, new retail services, or digital products. These alternative revenue sources reduce dependency on a single market and boost financial resilience.

Remember how restaurants sold to-go meal kits during the COVID-19 pandemic? That’s the precise strategy you want to consider for your shop. If you own a bakery, for example, online classes, downloadable recipes, or subscription boxes make great new revenue streams. This way, even if in-store sales decline, consumer spending continues across channels in different ways.

Power Up

Explore 10 popular retail services you can reinforce your store with during economic uncertainty, from product rentals to repair.

7. Curate your product selection with locally-sourced goods

Retailers hit by new tariffs on overseas suppliers, or those dealing with supply chain issues, should consider domestic alternatives. Instead of relying solely on imported goods, look for local vendors. Not only does this address tariff volatility and customer pricing issues, but it also aligns with a growing consumer preference for locally-made products.

A gift shop might collaborate with a local candle maker instead of importing similar products at higher costs. This not only protects profit margins, but also enhances storytelling and community connection.

Agile Vendor Management With Thrive Inventory

Assign multiple vendors to products in Thrive Inventory so you always know who’s selling at the lowest cost and you can protect your profit margins.

8. Form strategic partnerships to build mutual support

Collaborations expand your reach and add value with minimal cost. By tapping into other local businesses’ audiences and marketing platforms, both partners increase visibility and customer trust without significant financial investment.

A clothing boutique teaming up with a local jeweler for in-store events or co-branded packages form a partnership where customers are drawn to both companies. These collaborations support cross-promotion, drive traffic, and create a memorable customer experience during recession periods without requiring new inventory investment.

9. Drive sales by bundling items at discounted rates

Product bundling is a great way to offset price increases while growing perceived value. By cross-selling products in a bundle at a slightly reduced rate, you increase the average order value and reduce excess stock.

A skincare brand, for instance, could bundle cleanser, moisturizer, and SPF into a “summer skin starter kit” priced lower than the items sold individually. This tactic appeals to consumer price sensitivity while preserving your profit margins.

Power Up

Ready to get started with product bundling? Learn about the three different types, plus eight of our favorite product bundling strategies.

10. Always deliver memorable and seamless customer experiences

When shoppers are stressed about money, delivering excellent service becomes a key differentiator. Add small touches, like curbside pickup, packaging changes, and in-store events, to increase perceived value.

The more customers see your business go the extra mile, the more likely they are to return to your store, even when times are tough. After all, three out of four consumers are happily willing to spend more when it means a great customer experience.

Stay Agile And Ready To Adapt

The key to surviving in an unpredictable economy is flexibility. Small businesses that monitor trends, understand consumer behavior, and adjust quickly to changes in tariff policies, interest rates, and economic conditions will stay ahead.

Even in uncertain times, small retailers succeed by being resourceful, value-driven, and customer-focused. What works today may not work tomorrow, so test, measure, and refine your approach regularly. Whether you’re adjusting your product assortment, refining pricing strategies, or rethinking customer engagement, staying nimble ensures long-term sustainability.

And when the going gets tough, reach out to your support network. Talking, sharing ideas, and being a listening ear to other small business owners helps your company as much as your mental health.

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

The Only Inventory System That Actually Helps You Run A Healthy Business

Thousands of customers all over the world use Thrive Inventory to run a healthy business.

Thrive Inventory gives you control over all your inventory, sales channels, and metrics, allowing you to make the right decisions at the right time.

Keep Reading

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

Try Thrive Inventory For Free

Add Thrive Inventory to your business and maximize your potential. With powerful and easy-to-use products,

it’s time to take control of your business and see what you can do with Thrive Inventory.