The Complete Year-End Checklist For Small Business Owners

As the year comes to an end, you can prepare your small business for a smooth transition into the next year. You can use all the successes and lessons from your past several months of business to reach new highs next year. Below, learn how to create a year-end checklist for your small business and get off to a great start in the new year.

Checklists You Need For The Year-End

What’s The Purpose Of A Year-End Checklist?

A year-end checklist summarizes all the tasks small business owners need to complete before closing out the financial year. End-of-year checklists help small business owners stay organized during what’s often a busy, and sometimes stressful, time of year.

Year-end checklists are focused on financial tasks, taking a close look at business expenses, evaluating business accomplishments, reviewing internal workflows, or assessing marketing plans. They’re also appropriate for all sized businesses, from a sole proprietorship to a larger business with hundreds of employees.

How an end-of-year checklist sets you up for success

With an end-of-year checklist, you can make sure your small business has everything it needs before moving into the new year. It’s also the right time to tie up any loose ends, prepare for taxes, and set goals for the upcoming year. Your checklist should give you a clear view of where your business stands and help you set benchmarks for the next year.

As you run through your checklist, you can identify the processes that are working for your business. You can also pinpoint any practices you might want to change or do away with as you move into the new year.

Inventory Checklist For A Well-Run Back Office

Update vendor information

Make sure all your vendor information is updated and accurate. This includes email addresses, phone numbers, mailing addresses, and the names of vendor representatives. You should also go through your list, clear out any inactive vendors, and indicate vendors you’d like to work with in the future. These tasks on your end-of-year checklist should coincide with some of your regular vendor management practices, creating a win-win situation for you.

Thrive Inventory’s vendor management software organizes all your vendor information in our secure platform, not your head. Keep track of a supplier’s contact information, address, average shipping days, notes for internal use, and more.

Review your vendor contracts

It’s a good time to review terms and negotiate your vendor contracts while you have their performance data at your fingertips. For example, maybe you’ve found a vendor that offers a lower price for one of your products. Consider going to your current vendor and seeing if they’re willing to match that price.

While you’re reviewing terms, check to make sure your vendors are fulfilling their end of the agreement. Ensure that all deliverables have been met and all agreed-upon financial terms are satisfied. If they fell short, this may be a sign to review with a closer eye to ensure they can meet your needs next year.

Prepare your year-end sale

Once the holiday season rush has calmed, you might find that your business has some leftover inventory. However, high levels of unsold inventory can affect your tax returns – only purchases of inventory that you sell can be tax-deductible. You might want to plan one last sale for after the holidays so you’re not carrying lots of inventory into the new year.

Try not to include any of your new items in this sale. You want customers to see your brand as valuable, and discounting products that you just got in can detract from that idea. People are also more likely to shop during a sale if they know the offer will only be around for a limited time. To add a sense of urgency to this sale, try including inventory levels with your sales items. A “selling out soon!” sign or a “only four left!” popup can compel someone to buy something they might otherwise overlook.

Complete an end-of-year inventory count

A year-end inventory count is key for assessing your physical inventory and deciding how to handle them next year. During an inventory count, you’ll log your inventory levels using a spreadsheet or inventory management system.

From there, you’ll make notes that highlight any errors, discrepancies, or other notable information about your inventory. With this information, you can update your inventory notes and address any issues while figuring out how to prevent them in the future.

Spend Hours, Not Days Counting Your Inventory

Using a barcode scanner in Thrive Inventory saves time and increases accuracy. Eliminate writing or typing your entire inventory count by scanning each product’s barcode to count.

Financial Checklist For Your Business’s Fiscal Health

Generate income statements and balance sheets

A financial report is a key document for assessing the health of your business finances. It generally includes a balance sheet and an income statement. With these documents, you can see how well your business has performed from a monetary perspective.

A balance sheet looks at what your business owns, called its assets; any debt or other outstanding expenses, called liabilities; and what’s left when you subtract liabilities from assets, called equity. The final figure shows your business’s overall value. You can use your income statement to see your revenue and expenses.

Your income statement will also show your profit or loss for the period in question. To generate these financial statements, check for settings in your accounting software that export the precise information you need to evaluate.

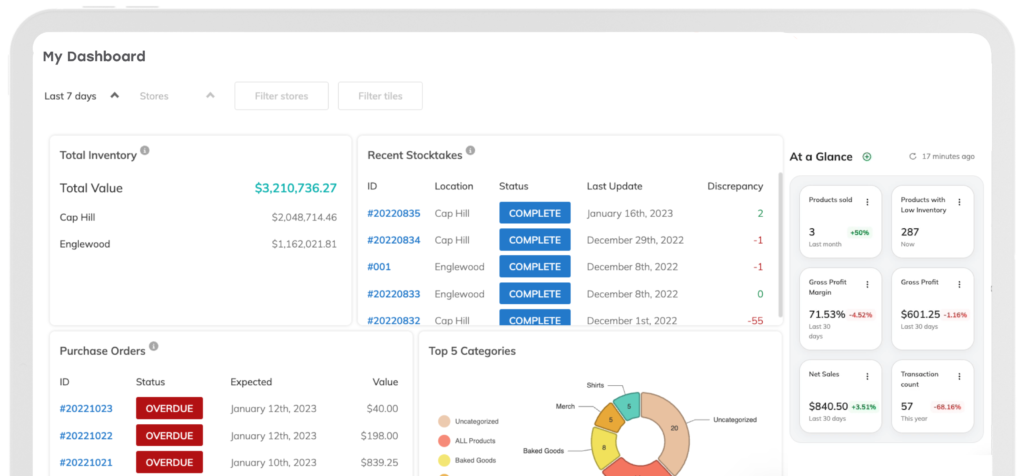

Investing in an inventory management software app, like Thrive Inventory, will calculate your ending inventory for you after you complete your year-end inventory count.

Power Up

Learn everything you need to know about calculating your ending inventory value by reading How To Calculate Ending Inventory Like A Pro.

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

Review your cash flow statements

Cash flow statements go hand in hand with balance sheets and income statements. They show your business’s financial records, paying particularly close attention to the money coming in and going out. They also evaluate how these cash flows affect your business’s operating activities. Think of your cash flow statement as an overview of all your business’s operating, investing, and financial activities. It shows you just how much money is running through your business at a particular time.

Say, for example, you purchased a case of notebooks for $50 and then sold it to a customer for $100. However, that customer agreed to pay you in $20 installments over the next five months. At this period of time, your business hasn’t reaped the full payment from the customer. While your profit would be $100 – $50 = $50, your cash flow would be $20 – $50 = $30. With this information, you know not to count the extra $80 toward a purchase you might want to make now.

Check payroll and employee information

There are a few payroll and employee-related areas you should review as a part of your small business end-of-year checklist. For example, let’s say your business offers employees educational or health benefits. In that case, you may need to reimburse some employees for payments they made earlier in the year. This also opens up the opportunity to discuss benefits with your employees and get an idea of which perks interest them and which may need revisions.

Another example: Has an employee been having issues with receiving your direct deposits? Now is the time to work on that problem. Are any employees due for raises or promotions? Look at your financial reports to see if there’s room for some pay increases. Thinking through this information now can help you make sure the employee-facing parts of your business are good to go for the coming year.

Organize paperwork

It can be easy to get lost in all your business’s paperwork. Staying on top of it now can keep the problem from getting out of hand and help you get more organized for the future. Try creating an organized system for storing all your important documents such as purchase orders, invoices, travel receipts, and employment applications. This way, when tax time comes or you need to pull a receipt for an order, you know exactly where to find your documents.

Employee Management Checklist

Verify employee information

Take time to revisit all your employee information. Verify that you have everyone’s current phone numbers and addresses. Make sure any employees you recently hired are fully processed in your payroll system. Sitting down to review this information now can save you time when you need to submit forms for your tax return.

Give out bonuses or end-of-year rewards

As a small business owner, you know your employees work hard to help your business succeed. You might want to offer them a reward or bonus at the end of the year to show your appreciation for all they do.

You don’t have to break the bank for this. Rewards can range from gift cards and personalized gifts to all-inclusive getaways. If you want to offer your employees a direct financial reward, consider giving them a bonus. On average, bonuses for hourly employees are 5.6 percent of their salary.

Gather feedback

One of the best ways to help move your small business forward is to get feedback from the people most invested in it. Your employees, customers, and investors might have some ideas based on their observations and experiences with your business over the past year.

Consider sending out customer surveys during the holidays when people are feeling generous and there’s more traffic coming to your store. Reach out to employees and schedule interviews toward the end of the year to review the past several months. During these interviews, you can discuss any changes your team thinks could benefit your company culture and your small business as a whole.

IT Checklist

Back up your computers and phones

Sure, you might already have your company’s devices set to automatically back up their information. But adding this step to your checklist can give you a bit more peace of mind when you’re closing out the year.

Your business’s computers have tons of sensitive information stored on them. Whether it’s your accounting system or payroll records, you want to fully secure the information that keeps your small business running.

Run a security checkup

Staying on top of your business’s security practices is key to protecting your company from cybersecurity breaches. You should run a security analysis on your business’s devices, internet servers, and other applications that handle and store your business’s information.

Get Your Free End Of Year Kit

After holiday sales, full inventory stock counts, calculating your ending inventory – it’s enough to keep a small business owner up at night! That’s why we built the guides and tools you need to navigate the end of the year with confidence.

If any employees have recently left your business, make sure you deactivate their key cards and remove their access to your company’s systems. You might also want to create a security plan that you can share with your employees. This way, everyone knows the part they play in securing your company’s data and lowering the risk of cybersecurity breaches.

Review your file-naming practices

If your business handles a lot of documents and reports, you might want to implement an official file-naming system. Ask yourself: Is there a way you can better name and organize your files? An official file-naming practice can help. What was once “Customerinvoice112” can become “KWalters_Invoice_6_Dec22.” This five-minute change can make quite a difference in how your business stays organized.

Marketing Checklist

Audit your website

Once your website is up and running, you might not think it needs much work. That’s not quite true. You should periodically review your site to find changes you can make to improve customers’ experiences.

Take a look at your site from a customer’s point of view. You might find that some areas are a bit difficult to navigate. Text might be wordy or out of date, or maybe it’s time to freshen your site’s look with new photos. Taking all these steps can maximize your impact with customers and drive impactful sales from your website.

Evaluate your marketing plan

Now that the year is coming to an end, closely review your marketing plan to see how well it’s been serving your business. Which sales campaigns had the best results? Which social media content received the most interactions? Reviewing your marketing plan from the past year can help you determine which approaches you should repurpose for the coming year. It can also spark ideas for new approaches.

Review your marketing budget

Make sure you made the best use of your marketing budget, and consider areas you might want to add to your marketing strategy. Try to find ways to better stick to your marketing budget in the future while still producing campaigns that lead to sales.

You can also review your budget to see where there might be room for new strategies to increase your marketing reach. For example, if you spent $5,000 on booth space at local craft fairs in the last year but didn’t make enough to justify that expense, it’s a sign to cut back on those types of events in the new year.

Business Goals Checklist

Review this year’s goals and your progress toward them

Take a moment to look back on your business performance over the last year. Consider how the goals you achieved benefited your business and how you can implement similar strategies for future goals. If there were any goals your business didn’t quite reach, think of ways you can pivot your team’s efforts to better navigate any issues.

Take a goal to increase sales by 25% in the calendar year, for example. If you increased sales by 28% this year, you know that you can continue to build upon that strategy in the new year. If your sales only increased 19%, it indicates that your strategy needs adjusting. With this approach, you can see your business’s progress over the years and figure out how to better set your team up for success.

Evaluate your KPIs

Key performance indicators (KPIs) are business metrics that help you understand how your small business is performing. They track specific areas within your company. Revenue, sales leads, employee satisfaction ratings, social media content views, and website traffic are all examples of KPIs. As a part of your checklist for the end of the year, you should review your KPIs to get an overview of your business’s success. You should also look for areas where you can improve.

Power Up

Not sure what metrics your business should be tracking? Read 7 Key Business Metrics You Should Be Tracking

Set goals for the coming year

Based on this year’s goals, you can set new goals for next year. You might set a higher bar to encourage growth and help your small business increase its potential. You should always make your business goals SMART: specific, measurable, achievable, relevant, and time-bound.

For example, you might want to improve employee retention. The SMART version of this goal would be to lower the turnover rate by 10 percent within three months. You might work toward this goal through training programs, team-building events, and employee appreciation programs. All in all, you’re more likely to accomplish SMART goals because they help you hone in on the fine details.

Reflecting On The Past To Prepare For The Future

When you create a year-end checklist, you take time to look back on the previous year. You can use these insights to best determine how to move your small business forward. With your checklist for the end of the year, you can thoroughly review your business’s performance – and prepare for a successful year ahead.

The Only Inventory System That Actually Helps You Run A Healthy Business

Thousands of customers all over the world use Thrive Inventory to run a healthy business.

Thrive Inventory gives you control over all your inventory, sales channels, and metrics, allowing you to make the right decisions at the right time.

Keep Reading

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

Try Thrive Inventory For Free

Add Thrive Inventory to your business and maximize your potential. With powerful and easy-to-use products, it’s time to take control of

your business and see what you can do with Thrive.