How To Price A Product: 6 Strategies For Setting A Price Tag

As a business owner, you understand that prices are not as simple as picking a number. It takes careful calculation to determine how much to charge. Finding the “sweet spot” that customers are willing to pay while ensuring profit for your business is key. In this article, you’ll learn the right strategies that take the guesswork out of product pricing.

What Are Product Prices?

Product prices are the amount a customer will pay for your merchandise or services. As a business owner, you calculate how much to charge.

Determining the appropriate pricing for your products is a strategic process that involves assessing a number of factors. These factors include product costs, profit margins, customer demand, and cash flow.

How To Price A Product

1. Determine your cost of goods sold

The cost of goods sold is the amount of money you’re spending on inventory. It’s an essential figure to know: Your gross profit margin – an important marker of your business’s financial health – is determined by subtracting the cost of goods sold from your total revenue.

You’ll need this value to construct your product pricing strategy in many cases. If you make a product by hand, your costs will include materials, labor, and equipment operations. If you order the product from a manufacturer, the cost is simply the price you paid for the item. The higher the cost of goods sold, the higher you’ll need to set your prices to keep your profit margins where you want them.

2. Calculate fixed costs

While setting a profit margin is an important step in product pricing, it’s just a starting point. A target price based on a desired profit margin doesn’t take fixed costs into account, so you’ll need to adjust your product selling price accordingly.

A simple way to incorporate fixed costs into your product pricing is to calculate the total amount of these expenses. You can then divide that value by the number of products you produced during a certain time period. For example, if you produce 100 products per month with fixed costs of $50, your fixed cost per product is $0.50. You can then add this amount to your target price for a better idea of how to price a product for retail.

3. Calculate the remaining costs

There are a few other variables that go into your pricing structure. Packaging costs, shipping rates, dropship facility fees, and e-commerce website management costs are a few examples of additional variable costs involved in selling a product to customers. While individually these costs might seem small, they’re a part of selling every item. They can quickly add up, so you should be sure to include these factors in your product pricing strategy.

4. Set a profit margin

A profit margin is a ratio that indicates how much your sales revenue exceeds your costs. Setting your target profit margin is an important step when it comes time to price your product, as it determines the amount of money you keep. Once you’ve determined your profit margin, you can set a target price based on this value. In most industries, an average profit margin is 10 percent, while a high-profit margin is 20 percent.

To calculate a target price based on your desired profit margin, add the variable costs of your product. Then, divide that value by one minus the decimal value of your set profit margin. Say, for example, the variable costs involved in making a quilt total to $12 and you’ve set a profit margin of 15 percent. You would calculate $12/(1-0.15). Your target price would be $14.12.

The Basics Of Product Pricing

Fixed costs vs. variable costs

Fixed and variable costs are the two main expense categories you’ll want to assess when determining product pricing. Fixed costs are expenses that are constant no matter your product output quantity or quality. Examples include the rent for your office space and loan payments. Variable costs, on the other hand, fluctuate based on your product’s output. Material prices, delivery costs, and gas prices are examples of variable costs.

Profit vs. revenue

While profit and revenue are often used interchangeably, these key business metrics refer to different aspects of your income. Profit is the amount of money you make from your sales after you’ve subtracted the total cost of goods sold and your business expenses. Revenue is the amount of money your business generates without taking your expenses into account. For example, if your business sold $3,000 worth of products in a day, your revenue is $3,000. Say you have $400 worth of expenses for the day. Your profit is $2,600.

Evaluating competitors

Looking at how your competitors are pricing their products can help you gauge where to set your prices. This approach can help you look at your product pricing through your customers’ eyes. Will they see your selling prices as reasonable or overpriced for the market? The average market price across competitors can help you make an informed decision.

Assessing market demand

In addition to evaluating your competitors’ product pricing, you should also conduct some market research to get an idea of the demand surrounding your product. In most cases, a higher demand for products means that customers are willing to pay more for products than when they’re not in demand.

A product’s availability can also affect its demand. If you’re the only business in the area that sells a particular product, you might be able to charge more money for this item. That’s another reason to check out your competition. This way, you know what your competitors are selling, what customers are looking for, and how to price your product to act on the demand.

Evaluating your target market

Your business’s target market is the customer base you’re aiming to reach. Knowing your customer base can help you create a product pricing strategy that keeps your customers’ budgets in mind. From there, you can determine a product selling price that’s ideal for you and your customers.

Age, gender, occupation, and earnings are all aspects of your target market you should consider as you create a product pricing strategy. This way, you better understand your customer base and how to price your products to align with their needs.

Popular Types Of Pricing Strategies

Competition-based pricing

With this pricing strategy, you’ll use your product’s market rate (also called going rate) to determine a fair price to charge customers. You can also use a similar product instead of your own product to help determine the price. For example, if your competitors are selling desk lamps for $40 each, your price should also be $40, or maybe a dollar or two over or under.

This pricing strategy only takes into account product pricing among competitors. It doesn’t factor in other aspects of product pricing such as customer demand or the cost of goods.

Cost-plus pricing

Perhaps the most straightforward pricing model is cost-plus pricing. It focuses entirely on the amount of money that goes into making a product and how much you’d like to earn once you’ve sold it.

To calculate cost-plus pricing, you’ll need to assess the cost of goods, production costs, and your desired profit margin. There’s not much research involved in cost-plus pricing strategy, either. Instead, it revolves around coming up with a selling price that delivers the profit margin you have in mind.

Let’s use a hand-poured soy wax candle as an example. Cost-plus pricing would factor in the costs of the wax, wick, jar, essential oils, and label. Production costs would calculate how long it took for you to make the product. The profit margin is set at your discretion. If the cost of goods totaled $5, your labor was calculated at $25, and you want to earn a 50% profit margin, your price per candle would be $45.

Dynamic pricing

A bit more advanced than cost-plus pricing, dynamic pricing is a flexible pricing strategy to determine a product selling price. Dynamic pricing gives you room to adjust your prices as markets and customer demand change.

For example, hotels often use dynamic pricing. Hotel prices are generally lower during the winter months. In the summertime, however, prices typically rise significantly as more people are vacationing and there are more events that people travel to attend. Cost-plus pricing would not fluctuate in this model; the hotel price would remain the same year-round.

Dynamic pricing can help you increase your profit margins throughout the year while keeping price points appealing to customers. Every so often, you’ll reassess variables that contribute to your product pricing to determine where you can make adjustments. You can also use A/B testing in dynamic pricing to test the prices your customers are willing to pay.

Value-based pricing

A value-based pricing strategy keeps customers’ budgets at the forefront. With this pricing strategy, you want to make sure you’re not losing money while ensuring the final selling price appeals to cost-conscious customers.

With value-based pricing, your goal is to not charge more for a product than customers are willing to pay. Researching the market and knowing your target customers is essential to acing this strategy. You’ll need to know who your ideal customers are in order to best price your products for them.

If you own a clothing boutique, value-based pricing would be calculated by first seeing how other competitor boutiques charge. If their customers are paying $100 for a dress, it’s a good indicator that you can charge the same and see how that price sits with your customers.

Penetration pricing

Penetration pricing is ideal if you’re a new business trying to enter a competitive market. This pricing strategy purposely sets your products at a competitive price so low that potential customers can’t refuse the deal. Using the example of a new electronics store, this shop may price smartphone charging cables at $20 and wireless headphones at $30 if their competitors price their items at $25 and $35 respectively.

The profit margins resulting from penetration pricing may be very low or, sometimes, negative, but when used strategically, this electronics store can use it to more effectively win customers.

You’ll gradually raise your prices to cover your expenses and produce your desired profit margins. This is possible since you’ve already wowed your customers with your extraordinary product at initially low prices. The hope is that they’ll continue shopping with you even if they have to pay a little more now.

Price skimming

Price skimming stands in contrast to penetration pricing. It’s the act of a business initially charging higher prices, and even the highest possible price in some cases, and then reducing the selling price as the product’s popularity decreases. This approach to retail prices is largely based on customer demand, so conducting market research is essential to effectively executing this product pricing strategy.

How To Price Handmade Products

1. Materials

You work hard to create something truly one-of-a-kind – how do you possibly put a price tag on that special handmade scarf? Start with the cost of the materials used to craft your products. Include all of your most insignificant materials, packaging, shipping, and other items you use to make your products. These are all overhead costs necessary to ensure your business remains profitable.

2. Labor

Since labor is intangible, you’ll have to get a little creative with how you work this cost into your product selling price. Think about how much you would charge per hour to make your products if you were working for someone else. Multiply your hourly rate by the number of hours it takes to create each item. Now, you have your labor cost per item.

3. Fixed costs

Including fixed costs is just as important for pricing handmade items as it is for pricing manufactured products. Include your studio rent, utilities, repairs, web hosting, office supplies, promotional materials, processing fees, and every other cost to run your business. Divide those monthly costs by the number of items you sell (or plan to sell) each month to calculate your fixed costs per item.

4. Profit

How much profit would you like to make on this product? Don’t forget that earning a profit – and paying yourself – is important. You can set a profit margin and use the information in the previous steps to determine an average selling price that’s best for your needs.

Profit =

Expenses – Revenue

Revenue

x 100

You can also change your retail price to bring you closer to your target margin. This may be especially relevant if you operate in multiple cities, where costs fluctuate depending on the cost of living in that area. A store in an area with a very high cost of living, like New York City, would command higher prices than a lower cost of living area in suburban New York State. That’s because profit margins need to be higher to reflect elevated rents and other costs that rise with the cost of living.

How To Determine Pricing For Multiple Locations And Sales Channels

If your business has a brick-and-mortar location and an e-commerce store, calculating your average selling price might be a little more complex. You’ll ship some products, while others will go right out the door with your customers.

Here, you have a couple of options for pricing because the costs incurred are different for each sales channel. While you may skip out on the costs associated with operating a brick-and-mortar store when you offer e-commerce options, you may incur other expenses that can influence your product pricing. This is particularly relevant if you plan to offer free shipping – an important perk for many shoppers – and need to make up for the cost in your pricing calculations.

For more uniformity across your platforms, you can price all your products the same on all channels. You can then set your product pricing to account for the highest costs you’ll incur from producing an item. For example, you might price all of your candles to absorb the costs of your e-commerce site and the rent for your storefront.

How To Use Sales Reports To Inform Pricing

A sales report includes all the important information about your business’s sales. Revenue, profits, sales volume, and expenses are some of the key points a sales report covers. You can use a sales report to gather all the information you need to determine how to price your products.

Your sales report can give you an overview of how well your business is performing and where you can make any adjustments. Did your business barely get by this month? Maybe you could stand to increase your prices. You can use any information from a sales report to create or adjust your pricing strategy.

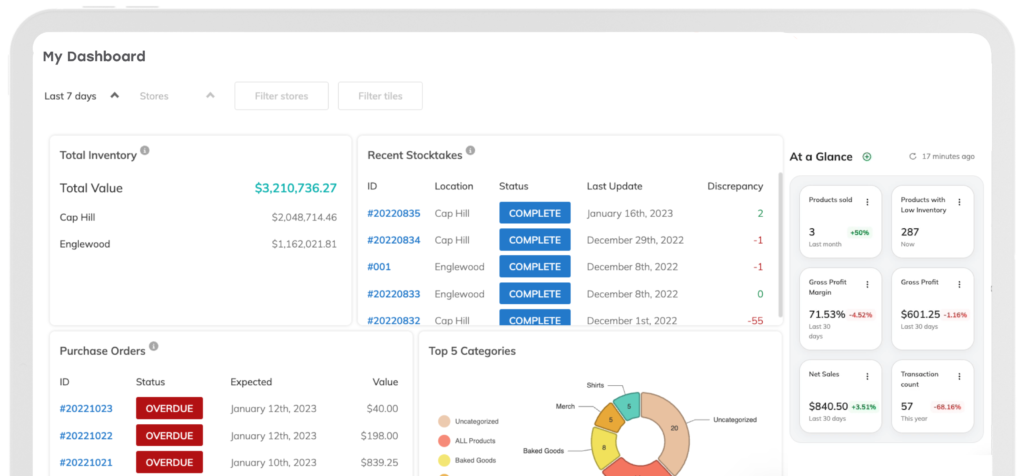

Unlock detailed sales and inventory insights with customizable reporting in tools like Thrive Inventory Metrics. Make business decisions based on data, not guesswork, by comparing sales performance between categories, storefronts, and sales channels.

Setting Product Prices That Grow Your Business

Pricing decisions are among the most important you’ll make for your company. There are several strategies you can choose from to create a pricing strategy that best serves your business and customers. Whether you decide to try price skimming or use the cost-plus pricing method, you can take a hands-on approach to pricing your products. With an effective pricing strategy in place, your business is on its way to generating the profits it needs to see growth and success.

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

The Only Inventory System That Actually Helps You Run A Healthy Business

Thousands of customers all over the world use Thrive Inventory to run a healthy business.

Thrive Inventory gives you control over all your inventory, sales channels, and metrics, allowing you to make the right decisions at the right time.

Keep Reading

The Newsletter For Small Businesses

Weekly expert insights, industry trends, and inspiring stories designed to help you run your business with confidence.

Try Thrive Inventory For Free

Add Thrive Inventory to your business and maximize your potential. With powerful and easy-to-use products, it’s time to take control of

your business and see what you can do with Thrive.